DeFi Lending Vaults Explained: Who Pays Your 5%, 10%, or 25% APY?

7 Mechanisms that Generate Yield for DeFi Lending Vaults

The recent TVL (total value locked) drop in Morpho’s large TVaults has renewed discussions about how lending protocols handle risk, liquidity, and user expectations.

Although the outflows were indirectly triggered by the Balancer hack and Stream Finance's recursive exposure, the episode highlighted differences in how DeFi lending markets are structured — and what is the real risk behind these vaults.

This post explains these differences, but first, we need a short background on how lending protocols work under the hood.

TL;DR

Seven Mechanisms That Drives APY in DeFi Lending

Borrow Demand & Utilization

Higher borrow usage → higher rates → higher APY for depositors.Liquidations & Collateral Volatility

Volatile collateral creates liquidation penalties and fees that flow back to LPs.Recursive / Leveraged Lending Loops

Strategies that borrow, swap, and re-deposit assets amplify interest generation.Asset-Specific Risk Premiums

Riskier or thinner markets pay higher rates to compensate LPs, e.g., leverage of Pendle PT tokensArbitrage-Driven Borrowing

Market fragmentation generates short-term borrowing spikes that lift APY.Strategy-Level Optimization (Morpho Vaults)

Curators rebalance, adjust leverage, and route capital to maximize yield.Incentives & Protocol Subsidies

Token rewards, liquidation fee sharing, or promotional incentives boost returns.

Background: How DeFi Lending Actually Works

DeFi lending is often explained in terms of “lenders” and “borrowers.” But this is not how the system actually works.

There are no individual lenders.

Users do not lend directly to each other. Instead, they deposit assets into a smart contract, which becomes the actual lender.

DeFi Lending has only 3 roles

Liquidity Providers (LPs) - users who deposit assets into the lending pool.

Borrowers - users who take out loans by posting collateral.

Curators - users or DAOs that decided on the risk parametrization of the lending market.

LPs do not choose who to lend to. Borrowers do not negotiate with LPs. A smart contract automatically connects both sides and sets interest rates based on supply and demand.

What is a liquidation?

Because borrowing is anonymous and thus (over-)collateralized, every borrower must maintain a minimum collateral ratio. When the value of collateral falls or debt grows, the loan becomes undercollateralized. At this point, the protocol automatically sells part of the collateral to repay the loan.

This automatic repayment is called a liquidation.

Liquidations are not failures. They are risk controls that protect LPs from loss.

These mechanics are the same across Aave, Morpho, and other lending protocols.

What differs is how risk is structured and how yield is generated.

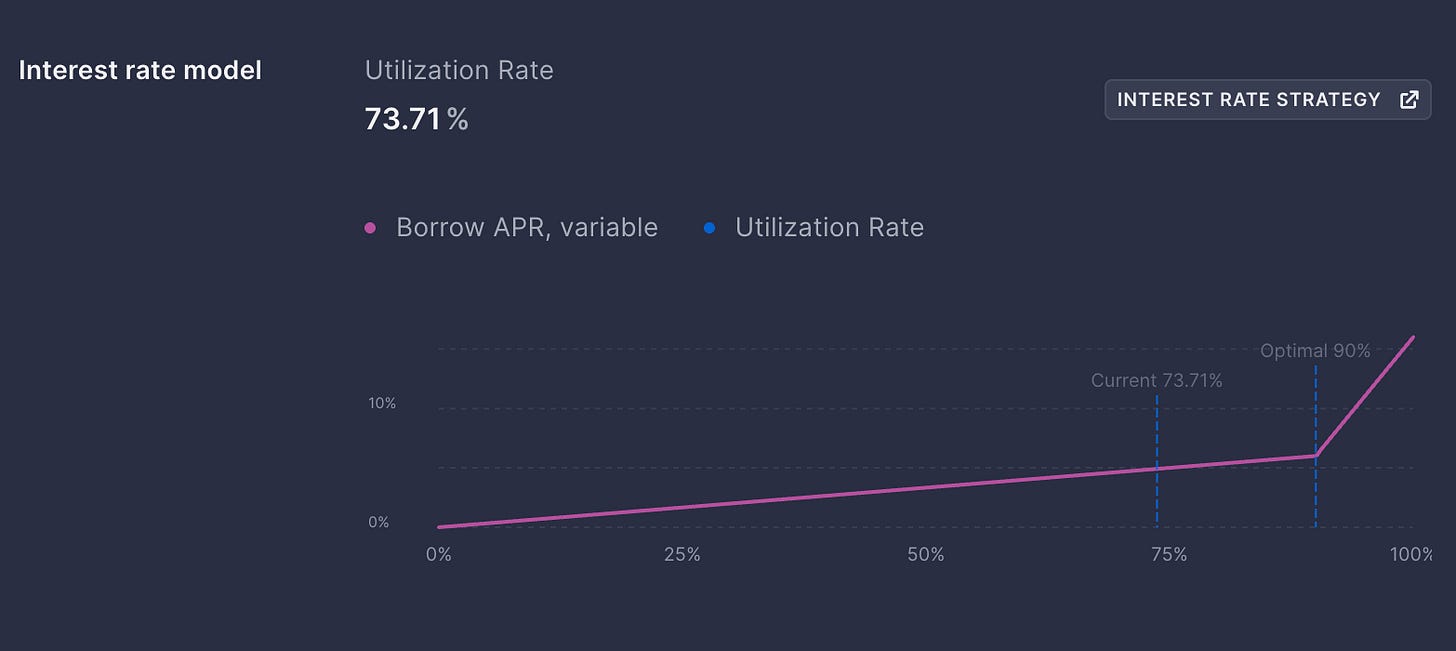

How Interest Rates Are Determined

Interest rates are set algorithmically, by a smart contract. The key variable is utilization — how much of the pool is borrowed versus available.

High utilization → rates increase → APY increases

Low utilization → rates fall → APY drops

Aave’s rate curves are standardized across the protocol. Morpho vaults may use curator strategies that shape utilization or borrow activity in different ways.

Aave vs. Morpho: Risk Parameter Governance

The biggest structural difference between Aave and Morpho lies in how risk is governed.

Aave

all risk parameters (LTV, liquidation thresholds, rate curves) are approved by the DAO

decisions are slow, conservative, and based on risk-provider analysis

behaviour is predictable across all markets

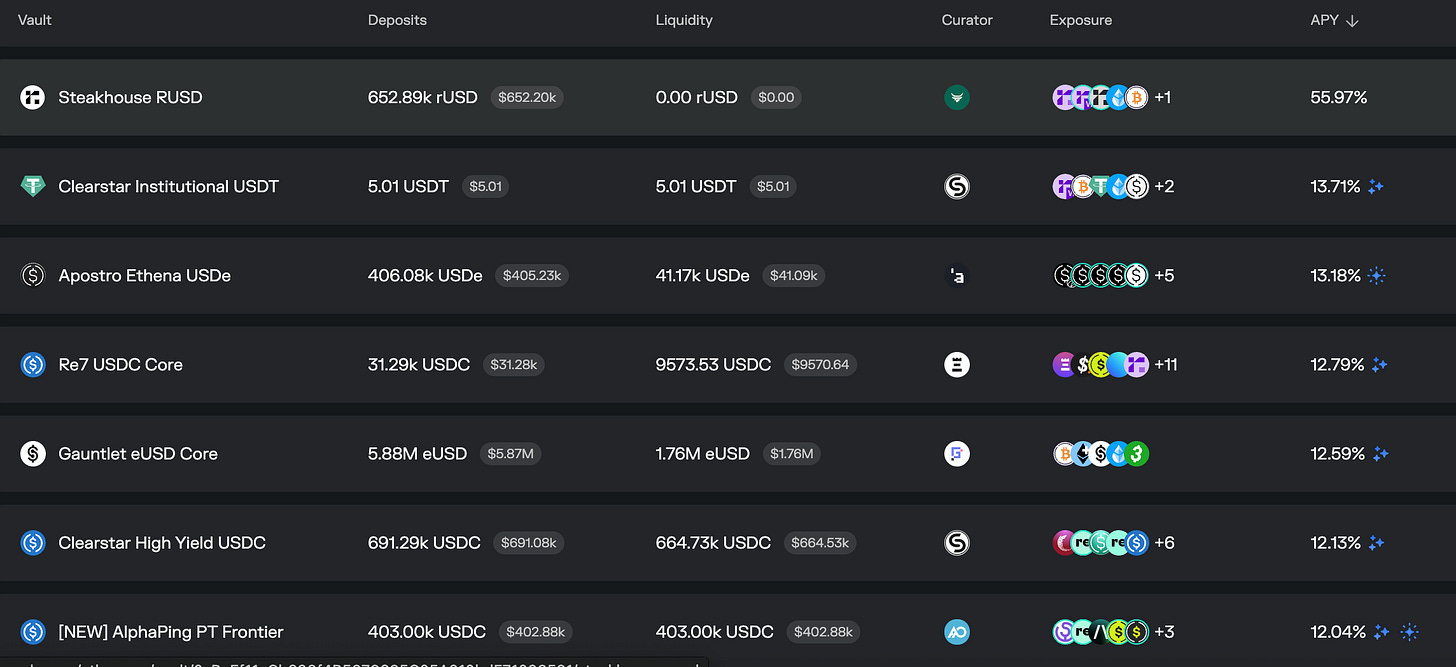

Morpho

vaults can be created permissionlessly

curators define asset sets, leverage patterns, and strategy logic

different vaults exhibit different risk/return profiles

behaviour depends on strategy internals, not a global risk model

Seven Mechanisms That Determine APY in DeFi Lending

Yield in DeFi lending is not magic. It emerges from a set of clear economic and technical mechanisms. Below, each mechanism is described in depth.

1. Borrow Demand and Utilization Dynamics

Borrowers pay interest, and LPs receive it. This is the baseline mechanism. When demand for leverage increases — for example, during:

bull markets

yield farming cycles

AMM arbitrage windows

funding-rate dislocations

borrow demand spikes, pushing utilization higher and lifting interest rates.

Aave responds passively to this. Morpho vaults can be designed to steer or target specific utilization zones. This mechanism explains most 2–6% APY environments.

2. Liquidations and Collateral Volatility

Liquidations generate meaningful revenue in volatile markets. When collateral loses value:

the protocol sells borrower collateral

liquidators pay back the debt

the system charges a liquidation premium

part of this premium flows back to LPs

High-volatility collateral → more liquidations → higher net returns for LPs.

Liquidation volume can be a larger APY contributor than interest rates during acute volatility phases.

3. Recursive or Leveraged Lending Loops

In many advanced vaults, a single position is leveraged multiple times:

deposit collateral

borrow against it

swap borrowed assets

deposit again

borrow more

repeat

This pattern increases:

total borrowing

utilization

interest paid

liquidation flow

yield for LPs

Aave is designed to avoid such loops. Morpho allows curated vaults to implement them intentionally. This is a key driver behind 10–20% APY environments.

4. Asset-Specific Risk Premiums

Different assets carry very different risk profiles. High APYs often correspond to assets that are:

volatile

thinly traded

newly listed

used heavily in leverage loops

correlated to broader market cycles

The protocol compensates LPs for bearing these risks through higher borrow rates.

Curators on Morpho can choose such markets to boost returns, with corresponding risk.

5. Arbitrage-Driven Borrowing and Market Fragmentation

When AMMs diverge in price across liquidity venues (e.g, Ethereum and its L2s):

arbitrageurs borrow large amounts of capital

they capture spreads

they repay loans quickly

Short bursts of arbitrage borrowing can dramatically increase utilization. This mechanism often drives short-term APY spikes.

6. Strategy-Level Optimization and Active Management

This mechanism is unique to Morpho curated vaults. Curators can implement active strategies, including:

dynamic rebalancing

selecting markets with predictable liquidation flow

adjusting leverage over time

routing capital across multiple lending venues

concentrating exposure strategically

adapting allocations to volatility regimes

These strategies amplify or stabilize yield depending on market conditions. Aave does not include any active strategy layer, its model is static by design.

7. Incentives, Rebates, and Protocol-Level Subsidies

APY is not always purely from interest. It can include:

governance token emissions

boost rewards

liquidation fee sharing

curator performance fees

promotional vault incentives

These external incentives can push APY far above baseline interest rates, especially in early-stage vaults. This mechanism explains many 20–30% APY periods.

Lessons for Users and Protocols

For users

Aave provides standardized, conservative risk.

Morpho offers strategy-driven yield that depends on curator design.

Liquidations and deleveraging are normal.

Always understand where yield originates.

For protocol designers

Strategy internals must be communicated clearly.

Transparency reduces fear-driven outflows.

Recursion, leverage, and concentration should be visible.

Stress-test frameworks improve user confidence.

Conclusion

Aave and Morpho represent two complementary models:

Aave: Stability through standardization.

Morpho: Efficiency through specialization.

Neither is inherently safer or riskier — they simply express risk in different ways.

The recent outflows are not a sign of structural weakness but a reminder that user understanding, transparency, and liquidation dynamics shape behaviour during stress.

As DeFi lending systems evolve, clarity will become just as important as yield.