Optimizing DeFi Liquidity: A Deep Dive into Capital Efficiency and Market Dynamics

Capital efficiency is a critical metric in DeFi, focusing on liquidity provision within Automated Market Makers (AMMs). In this blog post, we explore how LPs use it to maximize their rewards.

In my previous blog, "Reality of Yield Farming," I highlighted the significance for yield farmers, aka Liquidity Providers (LPs), to strategically

choose token pools with high trading volume and low Total Value Locked (TVL). This post delves further into the practices of professional LPs, explaining the intricacies of maximizing the volume/TVL coefficient, known as capital efficiency, and why some pools excel in this aspect while others fall short.

Reality of Yield Farming: Profits, Impermanent Loss and Loss-vs-Rebalancing

TL;DR Yield Farmer = Liquidity Provider (LP) Yield Farning = Liquidy Provision (LPing) providing liquidity (tokens) to DeFi smart contracts so that they can provide services to users in exchange for earned service fees, e.g. traders can swap tokens at DEXs,

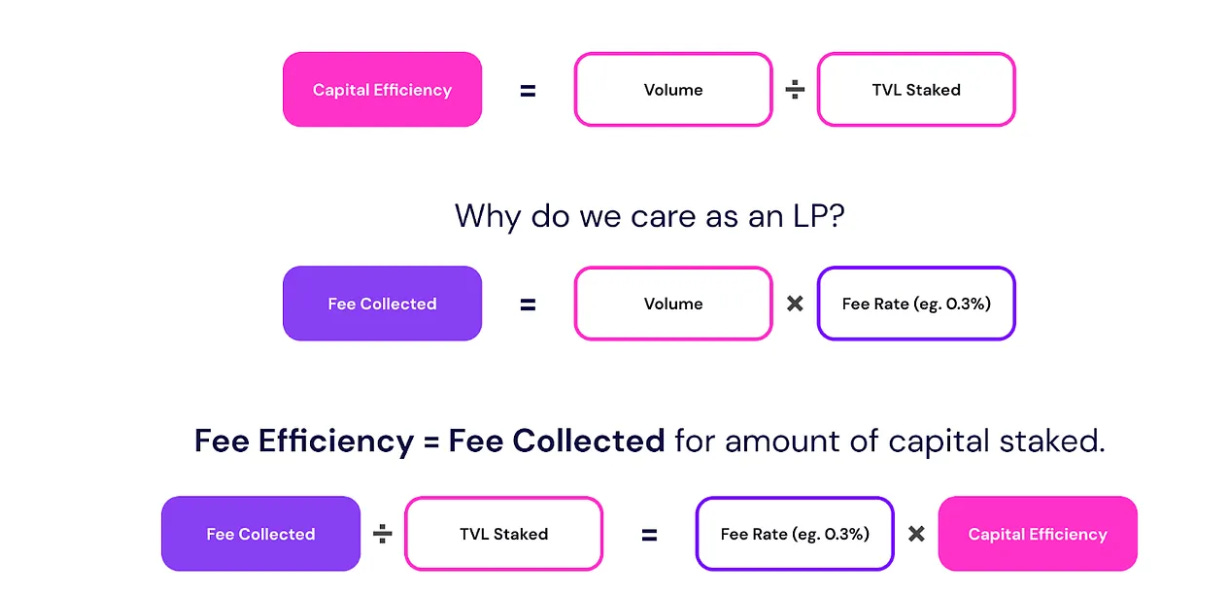

Defining Capital Efficiency

Source: Moveric Protocol

LP revenue from the liquidity pools is calculated based on the fee paid by traders, typically ranging from 0.1bps for stablecoin pairs to 100bps for volatile token pairs (1bps equals 0.01%).

Let’s explore a practical example involving an ETH-DAI pool and assume that this pool has a fee rate of 10bps, TVL 10mn and (daily) trading volume 1mn.

Then the revenue of LP (per each 1$ in the pool) is 1bps * 15mn/10mn = 1bps * 1.5 = 0.00015.

If LP allocated 100$ to this pool, after 1 year (assuming trading volume and TVL remain the same), the revenue is 0.00015 * 100$ * 365 = 5.475$, giving 5.457% annual return.

The coefficient Volume/TVL is known as capital efficiency. It tells how much LP would make by allocating $1k to 1bps pool. In our example pool, the capital efficiency is 1.5 (per day), meaning LP would earn 1.5 $ per day (by allocating 1k$ to 1bps pool).

The capital efficiency can be measured not only for each pool at DEX, but also for the whole DEX, or even chain, providing a high-level overview of LPing profitability.

Capital Efficiency of Chains

DeFiLlama provides daily TVL and trading volume data for various chains and protocols. Analyzing the largest chains, it's noteworthy that Ethereum, with nearly 2 billion in daily trading volume, exhibits a daily capital efficiency of just 0.29. Solana emerges as the most efficient chain in utilizing capital (TVL) to generate volume and fees. This analysis highlights that there is currently too much capital on Ethereum, given the current trading volumes.

The 3rd most capital-efficient chain is ThornChain, when looking at 24h volume, or zkSync Era, when analyzing 7d volume. What is more, zkSync Era is just 20th chain in terms of TVL, but 9th in terms of trading volume.

There is too much capital in Ethereum DEXs, given their trading volumes.

The capital efficiency varies between DEXs on each chain, with Curve (v1), (v2), and Uniswap (v3) optimizing it with concentrated liquidity. Let’s further analyze the TVL and trading volume break-down for the zkSync Era.

Capital Efficiency of DEXs

Analyzing capital efficiency per DEX is easier than per chain, as this value is directly reported by DeFiLama.

The average capital efficiency of zkSync Era is 1.23 per day (8.05 per 7 days). As we can see above, there are some DEX that are above this value - Maveric, Woo, PancakeSwap, .., and some underperform the chain average. The reason is the design of Automated Market Makers (AMMs) implemented by these DExs.

Understanding AMMs

Automated Market Makers (AMMs) are mathematical formulas implemented within smart contracts that determine token exchange prices. Unlike traditional financial exchanges (TradFi), AMMs do not rely on order books; instead, they establish exchange prices based on the number of tokens in liquidity pools.

CP - Constant Product Marekt Maker - Uniswap introduced the first AMM, CPMM, still utilized by Uniswap v2. CPMM is effective for exchanging prices of highly volatile or newly launched tokens, stabilizing their values over time.

CL - Concentrated Liquidity Market Maker - CLMM is an AMM in which liquidity is concentrated around the current token price, optimizing trading volume within that range. With lower capital requirements, CLMM can efficiently handle increased trading volumes compared to CPMM.

If you would like to learn more about AMM types, have a look at my previous blog on this topic:

Diving into DeFi: Decentralized Exchanges and the Rise of AMMs

Last week, I had the privilege of attending a DeFi lecture at the University of Zurich, where Henry and Magnus, two seasoned DeFi hedge fund managers, generously shared their insights into the world of decentralized finance (DeFi). This emerging financial ecosystem eliminates intermediaries by leveraging smart contracts to automate transactions. In this…

AMMs at zkSync Era

DEXs like Maveric, Woo, PancakeSwap, and Uniswap lead in capital efficiency (high trading volume with low TVL) on zkSync Era. They operate with concentrated liquidity similar to Uniswap v3 on the Ethereum mainnet.

Uniswap v3 Deployment: Uniswap v3 has recently been deployed to zkSync Era, utilized by both Uniswap and PancakeSwap. Maveric and Woo are also based on the Uniswap v3 model, incorporating enhancements.

SyncSwap and Curve Invariants: SyncSwap adopts concentrated liquidity models from Curve v1 and v2 on the mainnet. Unlike Uniswap v3, Curve does not require liquidity providers to actively manage LP positions; rebalancing is handled by AMM mathematics. SyncSwap's stable pool supports StableSwap Invariant AMM (Curve v1), ideal for trading pairs of stablecoins and pegged tokens.

Synthetic Proactive Market Making (sPMM): WooFi employs sPMM, a proactive market-making approach based on synthetic assets. The sPMM simulates a CEX order book in a DEX liquidity pool.

Time Weighted Average Market Making (TWAMM): Maveric utilizes TWAMM, an AMM that considers the time factor in price discovery. It works by breaking long-term orders into infinitely many infinitely small pieces and executing them smoothly against an embedded constant-product AMM over time (more in the Paradigm blog).

Directional LPing - is the second enhancement introduced by Maveric (Maveric blog). The disadvantage of Uniswap v3 is the need to constantly monitor, and re-balance (which costs gas fees), the LP-positions. In directional LPing at Maveric, LPs can define how the price range to which liquidity is provided should adjust.

TWAMM and Directional LPing are topics for separate blog posts. Make sure you subscribe to my newsletter to be the first to learn about them.

Conclusions

Liquidity Providers (LPs) strategically target pools with high trading volumes and low TVL. The volume/TVL coefficient, known as capital efficiency, provides an approximation of potential earnings for LPs engaging in liquidity provision.

Capital efficiency varies across pools, largely influenced by the choice of AMM by DEXs, offering insights into potential revenue for LPs in specific DEXs or blockchains.