Recursive Yield Loops: When DeFi Vaults Invest in Themselves

Recursive Capital in DeFi Vaults: When Transparency Is Not Comprehension

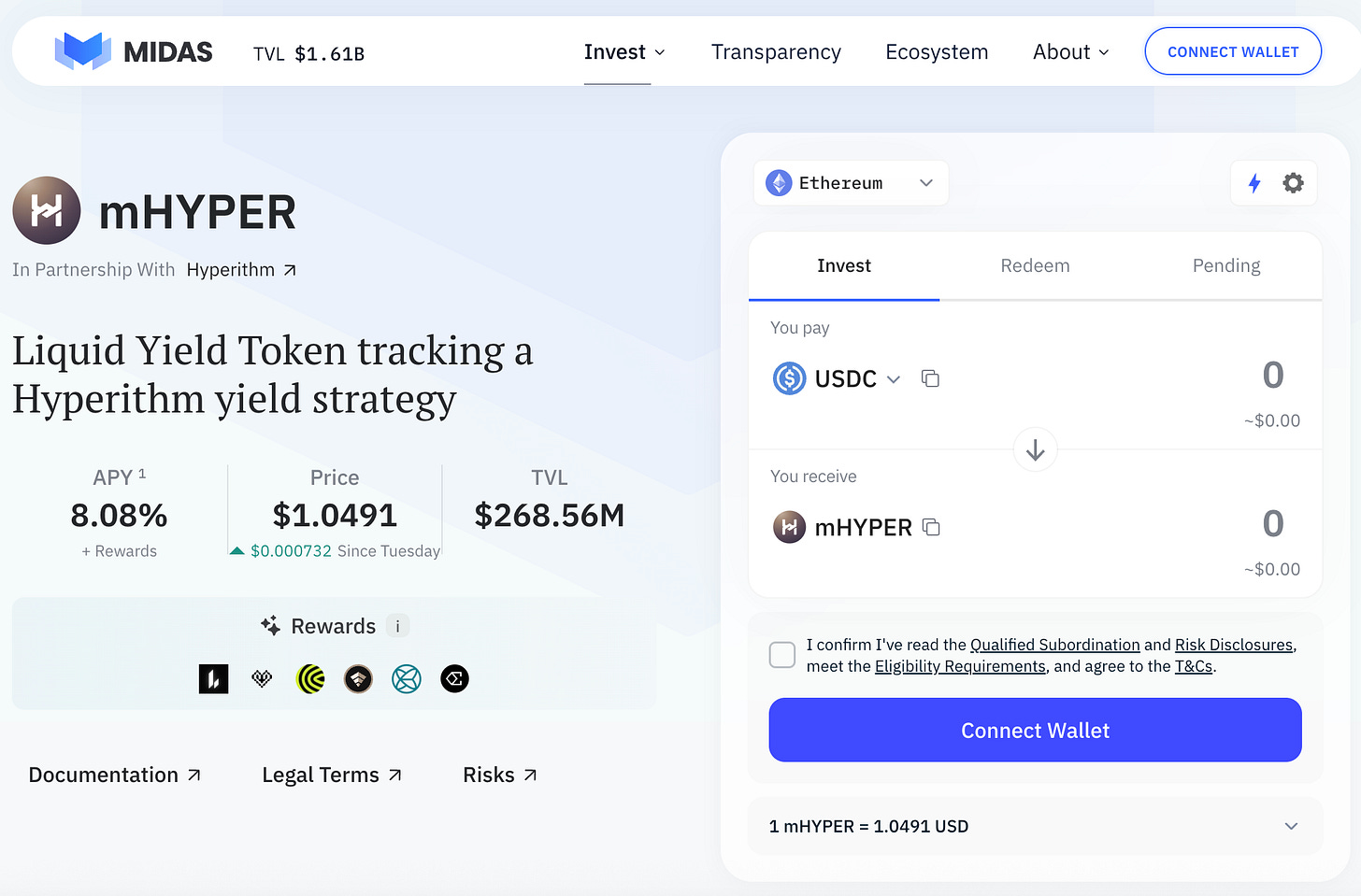

Last week, the DeFi community discussed one topic more than any other — recursive capital loops inside protocols like Hyperithm and Stream Finance. These cases show how composability in DeFi can both create yield and hide risks.

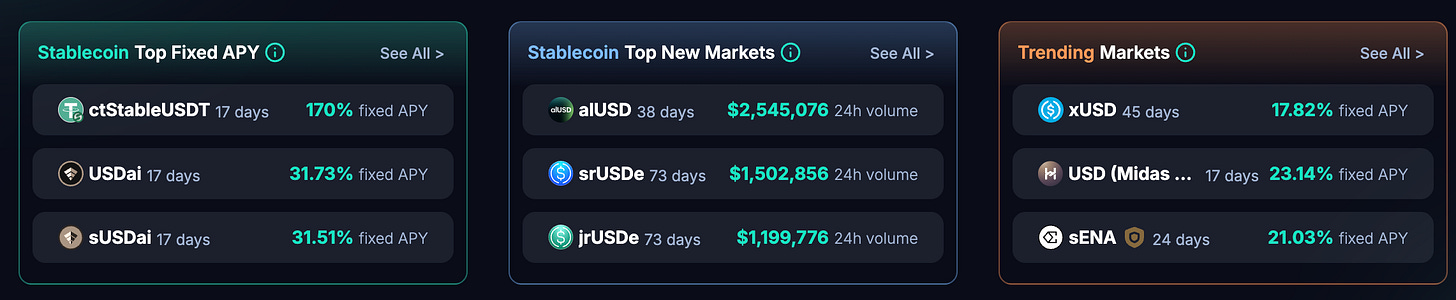

The era of earning 40–50% yields on stablecoins is long gone. Today, anything above 15% already raises questions about where that return comes from. Recursive capital exposure is one of the mechanisms that can make such high yields still achievable.

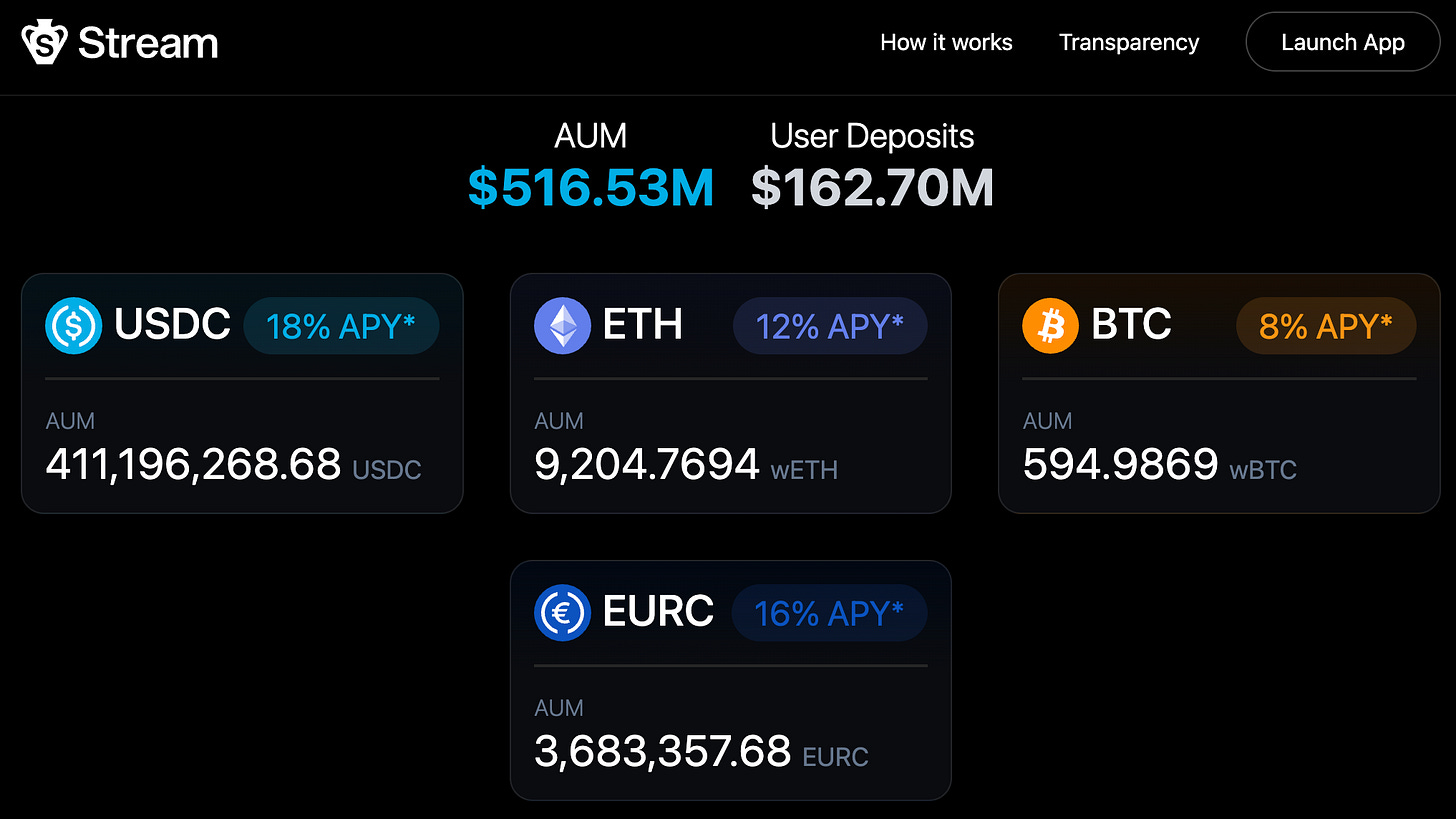

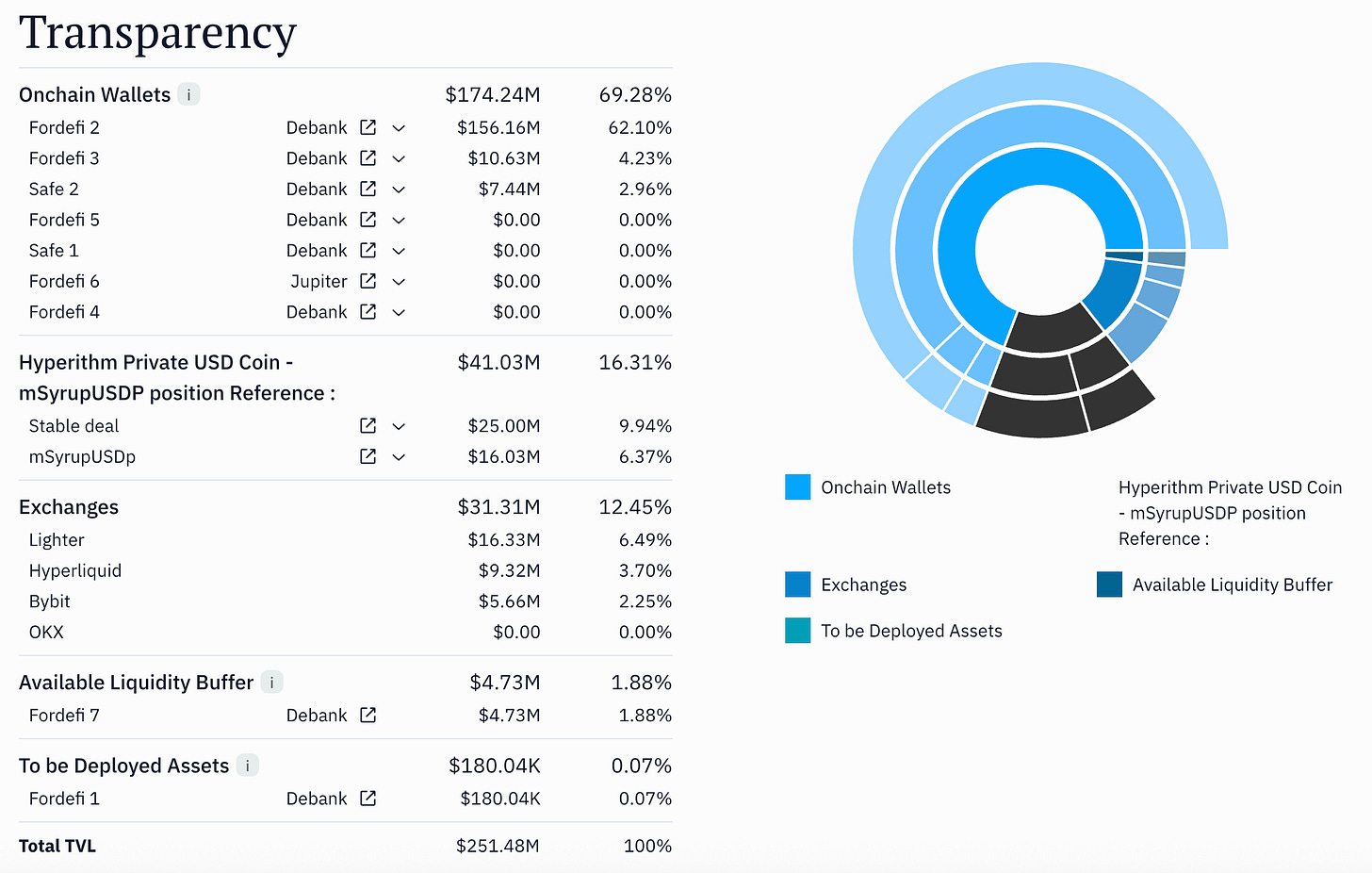

Whereas Stream Finance, with just $160mn of user deposits, reaches over $0.5bn capital exposure, Hyperthim announced the withdrawal of recursive capital exposure from its vault.

Let’s look at how these DeFi vaults work, where the yield really comes from, and why transparency doesn’t always mean understanding.

Background: The Core Yield Sources in DeFi

Despite the explosion of protocols, true yield in DeFi still comes from a few fundamental sources:

ETH staking — roughly 3%, based on Ethereum validator rewards.

Through leverage (e.g., borrowing against stETH), this can be pushed up to ~10%, but it introduces liquidation risk.Tokenized real-world assets (RWAs) — such as U.S. Treasury bills or invoice financing, typically yielding 4–5%.

These have become popular in “on-chain money markets” and tokenized vaults.Liquidity Provisions to DEX (Uniswap, Curve, Balancer) - providing liquidity to DEX earns trading fees. The main risk is impermanent loss, which can eat your rewards if you don’t rebalance your LP position often.

Curve and Balancer auto-rebalance, but Uniswap v3/v4 positions must be managed manually.

Liquidity Provisions to DeFI Lending (aave, Morpho) - you provide tokens to the liquidity pool, from which others can borrow tokens; a DeFi smart contract act like a lender and set the interest rates. There are two approaches for DeFi lending,

In the first DeFi lending model, used by Aave or Eurer, liqudity providers (LPs) select a pool of a token and provide liquidity to that pools (e.g. USDC or ETH). They need to watch out for the changing APY that is automatically adjusted by smart contracts to meet supply and demand.

In another approach (Morpho), LP you provide liquidity to vaults that are managed by curators. Vault managers distribute liquidity to the lending markets.

Unlike Aave, where each token has its own pool, in Morpho, each token pair, e.g., ETH-USC, has its own risk parameters and pool.

This makes the Morpho market more fragmented, but the curators manage the liquidity efficiently for LPs.

Yield-tokenizing protocols (Pendle) - split tokens into principal and yield parts. This helps hedge rate changes (in DeFi lending) or speculate on yield, and it’s often used for short-term trading.

Liquidity mining - Temporary incentives where protocols distribute governance tokens. These boosts don’t last and shouldn’t be mistaken for sustainable yield.

For example, Ripple currently subsidizes its RLUSD stablecoin to build early adoption. In Europe, due to MiCA regulations, stablecoin issuers are not allowed to distribute yield directly, so they often rely on similar indirect incentives to attract users.

Everything else - whether labeled as “DeFi yield,” “vault yield,” or “AI-optimized strategies” - builds on top of one of these base layers, often with leverage.

Tokenized Vaults: How They Work

Do these yeidl strategies sound complex? This is where DeFi vaults step in, and their managers do the job for you. On top of the “traditional investment“ of USDC or ETH into such DeFi vault, you can just buy a token representing the collective investments of the vault.

Tokenized vaults make yield composable. They work like liquid staking — but instead of staking ETH, you deposit stablecoins. Vault Managers, such as Hyperthim or MEV Capital (note: unrelated to MEV), invest them across various strategies and protocols, like Midas, which issues vault tokens representing your share.

These vault tokens are powerful because they:

Can be traded at DEX/CEX

Let you exit anytime without lockups via DEX/CEX;

Can be used as a collateral and for leverage

For example, imagine a vault paying 7% APY. You can deposit into it, receive a vault token, use that token as collateral on Aave or Morpho, borrow stablecoins, and buy more vault tokens. Now you earn yield on yield of 15%+ - a leverage loop.

Recursive Exposure: When Vaults Fund Themselves

In a healthy, competitive market, independent players provide liquidity for lending, trading, or manage the risk parameters of the pools.

But crypto markets are still maturing - and sometimes, the same (or related) entity ends up operating multiple sides of the trade.

Here’s what we see in the some cases. Vault managers:

Managed the vault,

Curated their own lending markets (e.g on Morpho) and provide vault liquidity to the lending market so that its depositors can leverage the vault token

Provided the initial liquidity to DEX (e.g. Balancer) so that the vault token has a price (and the lending market has an oracle)

Some vault mangers can even one step further: they

Re-used the vault liquidity to buy tokenized token vaults and leveraged these tokens to expand exposure.

In other words, the vault lent to itself, recursively amplifying the apparent Total Value Locked (TVL).

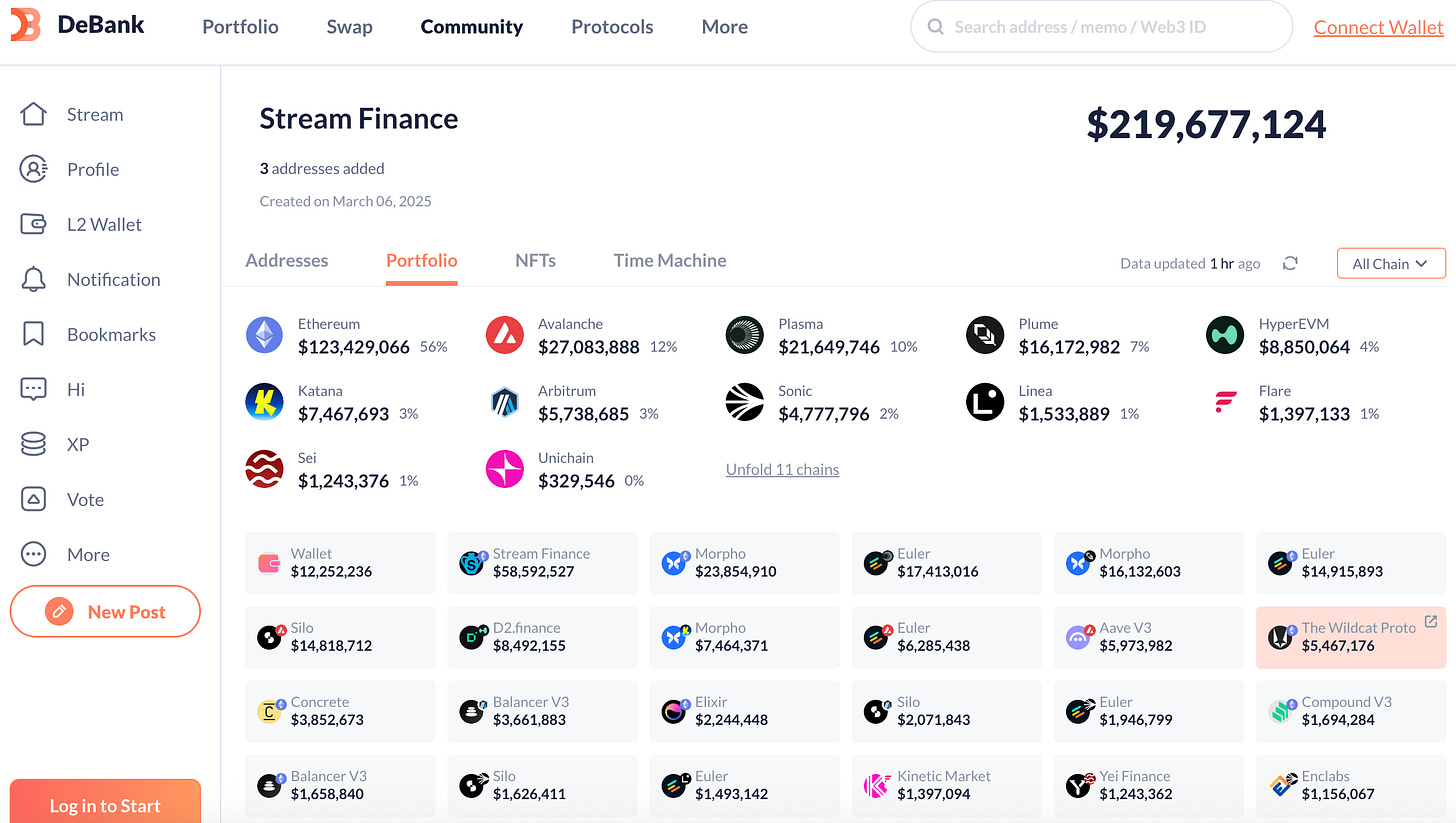

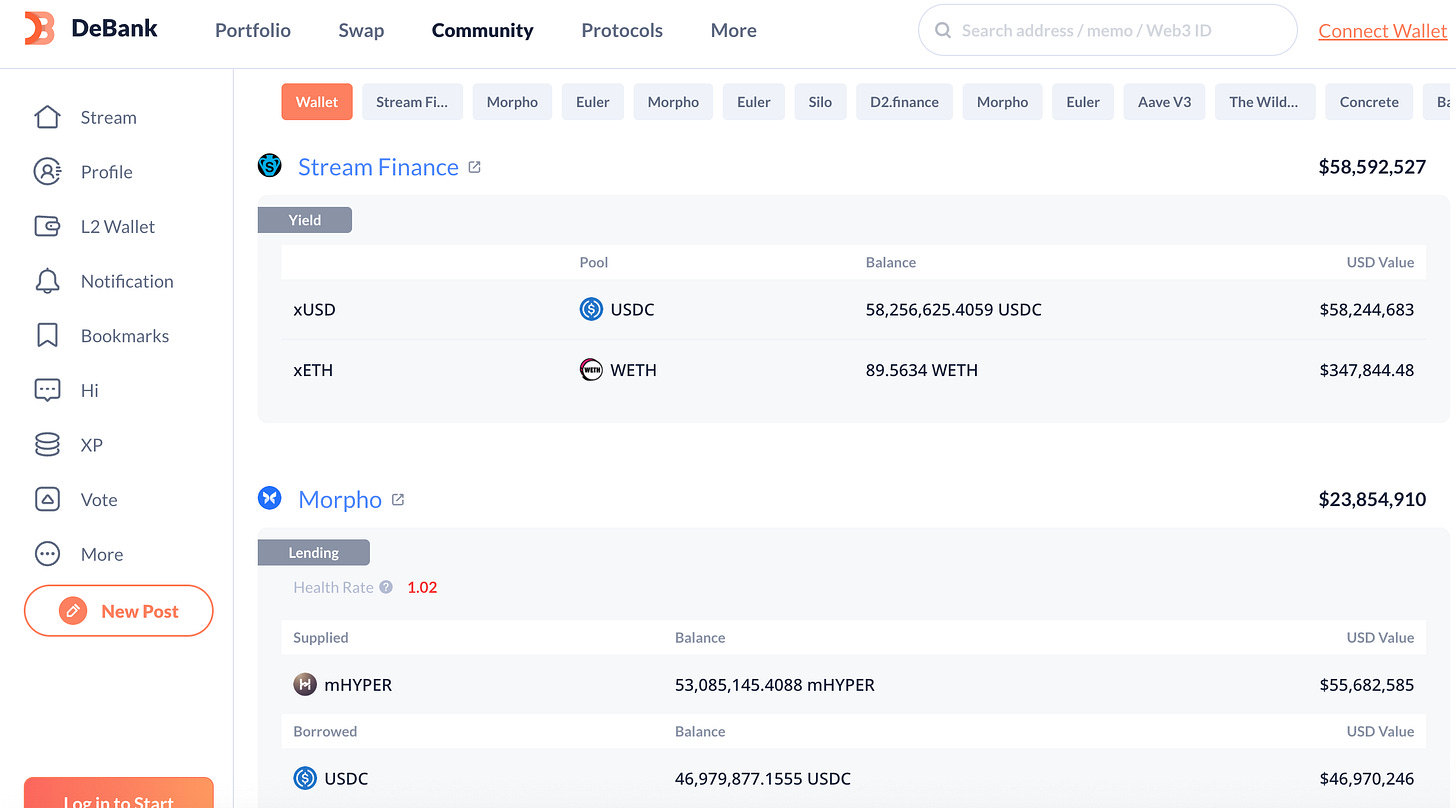

Take Stream Finance as an example. The DeBank of their wallet shows around $150 M in client deposits but manage over $500 M in “assets under management.”

That gap is the result of leverage layers: Level 1 (base vault) → Level 2 (re-deposited collateral) → Level 3 (vault tokens used as collateral again).

The Transparency Paradox

Here’s the irony: everything is fully on-chain and transparent. You can verify wallet allocations on DeBank, check positions on Etherscan, or even reconstruct flows directly from smart contract data.

The problem is that most users don’t - and often can’t. Reading vault structures and inter-protocol dependencies requires on-chain literacy that only a handful of data scientists or blockchain analysts possess.

So while projects like Stream Finance or Hyperithm are technically transparent, their risk structures remain practically opaque to most investors.

Recursive capital deployment isn’t inherently bad. When managed well, it can increase capital efficiency and optimize liquidity utilization. But it also amplifies risk correlation - a failure in one layer can cascade through all others.

The key question isn’t whether recursion is right or wrong - it’s whether users understand it and whether disclosures are clear enough to reflect the true leverage behind that “17% APY.”

Closing Thoughts

DeFi remains influence-driven: narratives move faster than understanding. Even when protocols are transparent, very few participants interpret the data before aping in. Thus, you must always Do your due diligence — or find someone who can.

Ignore slogans and dashboards; the truth lives on-chain.

If you’re unsure, look for independent analyses or community audits that break down the vault’s positions and counterparties.Transparency without comprehension is just noise. And in recursive systems, that noise can echo very loudly.

Transparency without comprehension is just noise.

And in recursive systems, that noise can echo very loudly.