Unlocking Liquidity: The 3 Essential Requirements for Tokenized Real-World Assets

The true potential of tokenization lies not just in the act itself but in meeting three key requirements that pave the way for liquidity to flow seamlessly through the decentralized finance ecosystem

TL;DR

The successful Tokenized RWA must meet the three key requirements:

Listing at Automated Market Makers (AMM)

Deployment to decentralized and EVM-compatible chain

Acquiring rewards (coupon payments) constantly in the token value

Introduction

The fusion of decentralized finance (DeFi) and traditional finance (TradFi) is becoming increasingly seamless. Tokenization, the process of converting real-world assets (RWAs) into digital tokens, has emerged as a powerful tool to bridge the gap between the two financial systems. However, the true potential of tokenization lies not just in the act itself but in meeting three key requirements that pave the way for liquidity to flow seamlessly through the decentralized ecosystem.

Source: CoinGecko

The idea for this blog was spared by the post from ChainlInk about the 3 technical requirements for tokenized RWA (link). Whereas system security is a must, it is often insufficient to build a profitable business model.

At DeFiLlama portal, you can see the overview by total value locked (TVL) of the tokenization protocols:

Tokenization protocols by TVL (source: https://defillama.com/protocols/RWA)

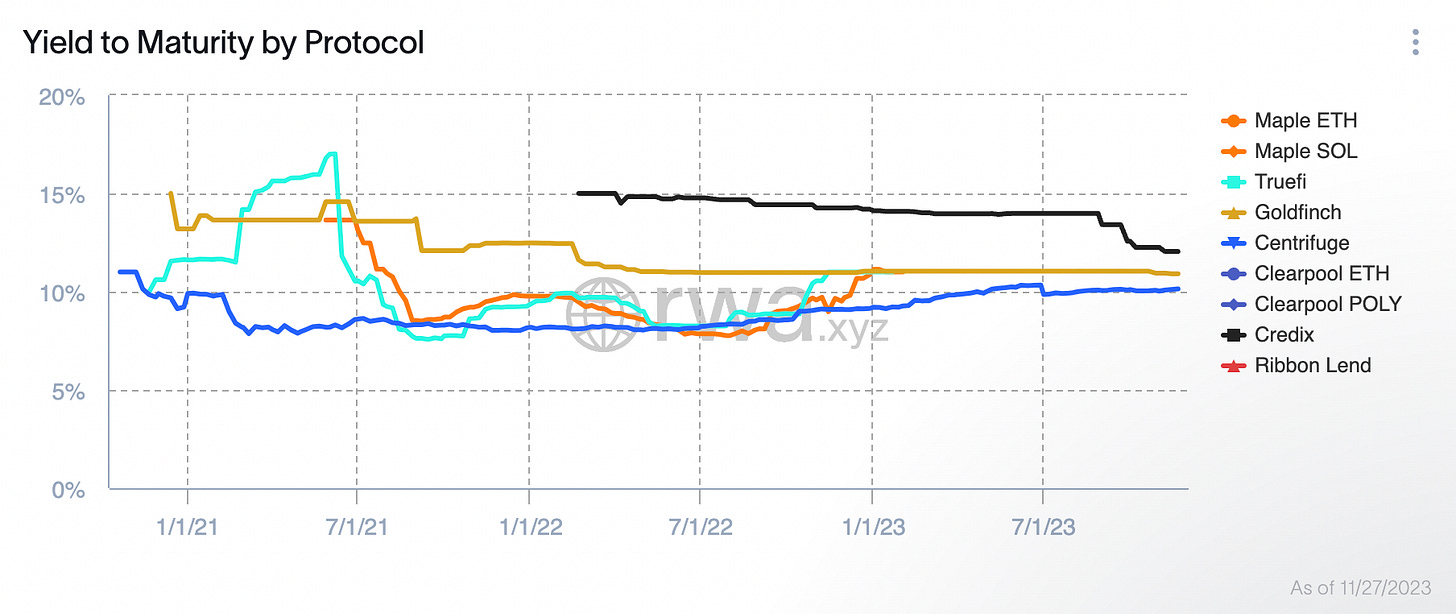

Another interesting overview is presented by RWA.xyz where the tokenization projects are grouped into private credits and US. Treasury bills.

Yield to Maturity by Private Credit Protocols (source: https://app.rwa.xyz/)

Let’s delve into the factors that the most successful tokenization protocol has in common.

1. Listing at Automated Market Maker (AMM)

Tokenization promises to inject liquidity into traditionally illiquid assets like real estate, art, and financial instruments. However, the magic doesn't happen solely through tokenization. The real catalyst is the listing at the smart contracts with Automated Market Makers (AMM) on Decentralized Exchanges (DEX).

AMMs, a form of decentralized exchange, facilitate the trading of tokens without relying on traditional market makers. Instead, prices are determined algorithmically based on token reserves. You can read more about AMM in my previous blog:

Diving into DeFi: Decentralized Exchanges and the Rise of AMMs

Last week, I had the privilege of attending a DeFi lecture at the University of Zurich, where Henry and Magnus, two seasoned DeFi hedge fund managers, generously shared their insights into the world of decentralized finance (DeFi). This emerging financial ecosystem eliminates intermediaries by leveraging smart contracts to automate transactions. In this…

How to list tokenized RWA at AMMs?

Tokenization projects achieve listing AMM in one of two ways:

a) by deploying their own smart contracts with AMM capabilities, ensuring that investors can buy or sell their tokens 24/7. This approach is used by Aktionariat that tokenize equities of Swiss SME.

b) by deploying to the AMMs already operating in DeFi, e.g, tokens of ESG projects in Africa from Frigg are listed at Uniswap

While AMM provides unparalleled accessibility and liquidity, large-volume trades may introduce price fluctuations (called slippage in DeFi).

Holders of tokenized RWAs may not always actively trade at AMMs, but the assurance that the option to buy or sell tokens 24/7 just exists, adds a layer of security to their investments.

The initial liquidity provider (LP) in the AMM pool is typically the asset owner, allocating a percentage of tokenized tokens to be part of the pool and accepting potential impermanent loss.

2.EVM-Compatible and Decentralized Chain

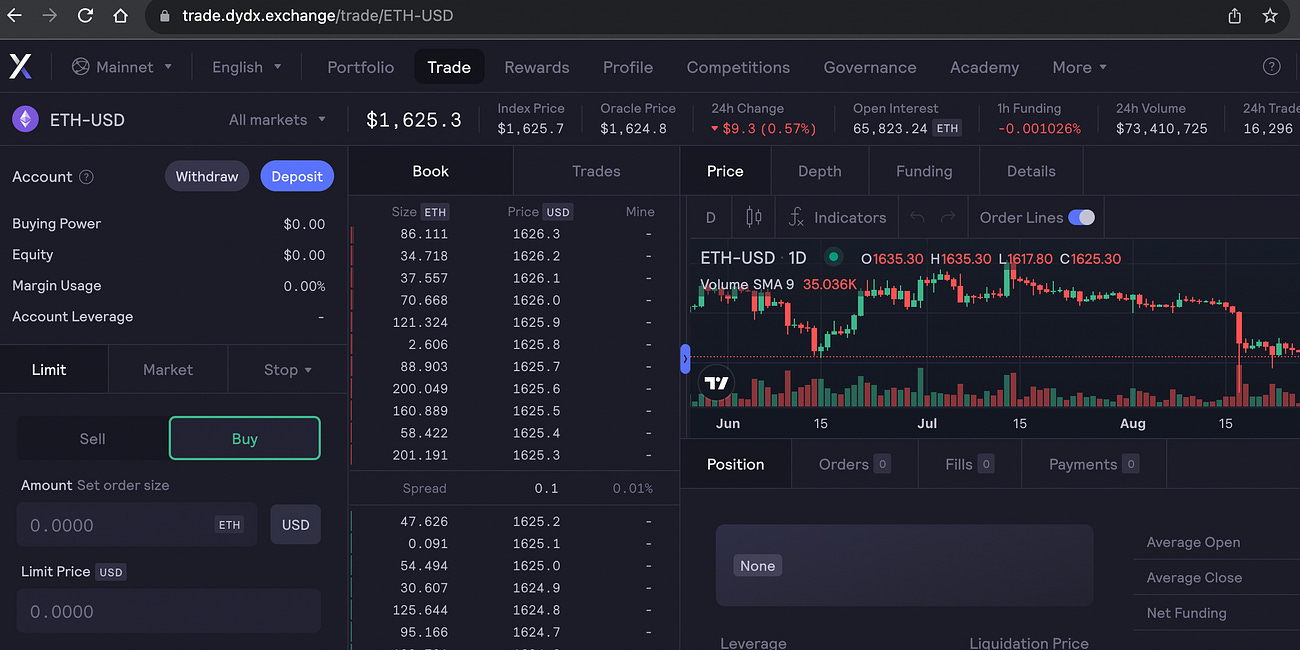

Choosing the right blockchain is crucial for the success of tokenized RWAs. While there are numerous options, Ethereum Virtual Machine (EVM)-compatible chains offer the best spectrum of utility. The reason is that Ethereum is simply the home to the majority of DeFi in any metric you use (capital, users, ecosystem, developer activity). In EVM-compatible chains, not only can tokens be traded on AMMs, but they can also interact with other DeFi protocols, such as lending platforms.

Users do not want to just hold their tokens in wallet, they want to swap them at AMMs, use as collater at the lending protocol to buy other, leverage, and mint stablecoin, issue derivatives… The successful tokenized RWA are a part of DeFi ecosystem

Source: RWA.xyz

Though Ethereum is a popular choice, other EVM-chains e.g. Polygon, and emerging roll-ups on Ethereum (Arbitrum, Optimism, zkSync, etc.) provide alternatives. Despite the temptation to deploy on Ethereum - the blockchain with the majority of users and capital, considerations like lower fees on alternative chains, especially roll-ups (layer-2 on Ethereum), make a significant impact. For example, Obligate, specializing in tokenization of dept, typically deploys the tokens to the Polygon chain that is a plasma/validium to Eherereum. You can read more on plasma and other layer-2 is my previous blogs to learn how to inherit the Ethereum security.

Decentralization and resistance to censorship are critical factors when selecting a blockchain for tokenization. The immutable nature of blockchain is a cornerstone of its appeal, but the level of decentralization varies across different networks, influencing their resilience to attacks. Maybe you heard about 51% attacks on Bitcoin and 66% on Ethereum? Just remember that some blokchains are run by millions of miners or validators with billions of staked, while others rely on as little as 7 or 21 servers.

3. Accrue Interests in Value

Tokenization in the DeFi realm operates on a different paradigm compared to traditional finance. Waiting for coupon payments until maturity is no go. The DeFi tokens (e.g. liquid staking tokens or successful tokenized RWAs) are reward-bearing. This means that the interest accrual happens daily and is reflected in the token value.

For instance, instruments tokenized by Backed Finance accumulate interest on a daily constant. This presents a dual advantage: holding tokens allows for their appreciation as they accrue interest, and leveraging these tokens as collateral opens avenues for borrowing other assets.

If you are curious how leverging in DeFi works, check out my blog about three trends in DeFi. I explain there how you can leverage the sDAI (number one in DeFiLama table at the top). The sDAI is an example of yield-bearing tokens claiming 5% pa (with 80% of revenue coming from tokenized US. treasury bills) and by leveraging with flash loans, the rewards could go up to 14% according the the technical simulations.

Deep Dive into Top3 DeFi Trends: Perps, Liquid Staking and RWAs

While total value locked (TVL) in DeFi is at the two-year level low, some protocols are doing better than others. The winner of the crypto winter is liquid staking. Within months, it became the largest category in DeFi with over $20b2n TVL (source: DeFiLlama). Lido, the first liquid staking protocol, became the largest DeFi protocol (ca $14bn TVL), an…

Conclusions

Tokenization acts as the bridge that brings liquidity to previously illiquid assets. Yet, it's not a standalone process; it requires integration with AMM-DEX, deployment on EVM-compatible chains, and the incorporation of interest-bearing mechanisms. As the boundaries between DeFi and traditional finance blur, understanding and implementing these three requirements become paramount for any successful tokenization project. Remember, blockchain has the potential to bring liquidity to any real-world asset, the key lies in navigating these complexities to unlock its full power. FriendTech tokenizes people and allows to trade their shares via smart contracts with a 3-line pricing formula.