Who Decides Ethereum’s Future? Understanding the EIP Process through the Pectra Upgrade

EIP-7251: Raising the Validator Stake LimitEIP-7251: Raising the Validator Stake Limit

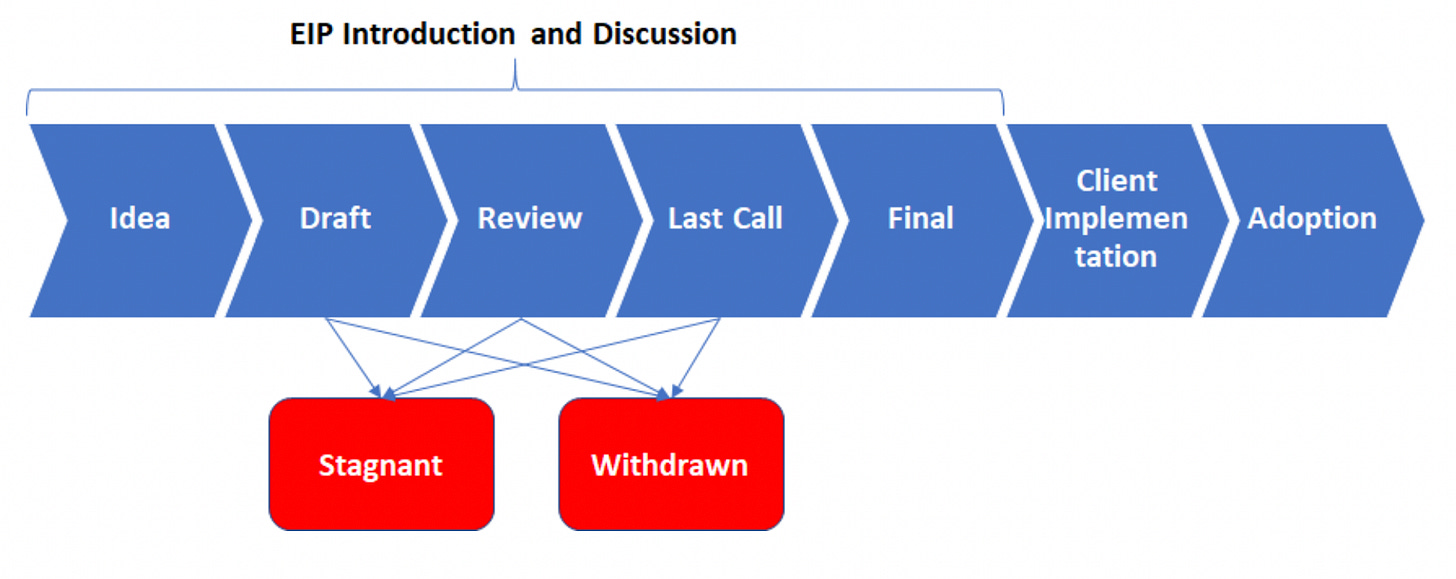

Since its inception in 2015, Ethereum has undergone over twenty major network upgrades. These protocol changes are coordinated through the Ethereum Improvement Proposal (EIP) process—a mechanism that allows the community to propose, evaluate, and implement changes to Ethereum’s protocol design.

Contrary to common assumptions, Ethereum upgrades are not dictated by any single organization, including the Ethereum Foundation. Instead, they emerge from a decentralized, consensus-driven process involving client teams, researchers, and ecosystem contributors. The upcoming Pectra upgrade serves as a timely example of how this process functions in practice.

What Are Ethereum Improvement Proposals (EIPs)?

An EIP is a structured design document that proposes a change to the Ethereum protocol. It typically includes a rationale, technical specification, and motivation. While anyone may submit an EIP, the majority are authored by:

Ethereum client developers (e.g., Nethermind, Geth, Prysm, Lighthouse)

Ethereum Foundation researchers

Protocol designers and infrastructure teams

The process does not rely on token-based voting. Instead, EIPs progress through open discussion and technical consensus among implementers and researchers.

Ethereum's Evolution Through Major Upgrades

Ethereum’s capacity to evolve is a defining feature of its design. Previous upgrades have redefined the protocol’s architecture and use cases:

The Merge (2022): It marked Ethereum’s shift from Proof of Work to Proof of Stake. It drastically reduced energy consumption and introduced staking as a core security mechanism.

Dencun (2024): This upgrade significantly improved Ethereum’s scalability by lowering data availability costs on Layer-2 rollups. It introduced “blobs” (via EIP-4844) to make rollup transactions cheaper, sparking a surge in L2 adoption across the ecosystem.

Each upgrade represents a deliberate step forward—addressing scalability, efficiency, and decentralization through incremental and community-coordinated change. Pectra continues this tradition.

How Are EIPs Selected for Network Upgrades?

The selection and inclusion of EIPs follow a multi-stage process:

1. Review via AllCoreDevs Calls

Biweekly meetings involving Ethereum client teams (AllCoreDevs) serve as the primary forum for EIP discussion. Here, proposals are debated based on feasibility, risk, and priority. Decisions are reached through rough consensus, not formal voting.

2. Client Implementation

No EIP is considered final until it is implemented by multiple independent clients. This distributed implementation requirement ensures that proposals are technically sound and have broad developer support.

3. Community Engagement

The wider Ethereum community—including staking providers, dApp developers, and wallet teams—contributes through discussions on forums such as Ethereum Magicians, GitHub, and ETHResearch.

4. Testing and Coordination

Once a set of EIPs reaches consensus, they are bundled into a network upgrade. These undergo rigorous testing on devnets, testnets, and shadow forks before mainnet activation.

Case Study: The Pectra Upgrade

The Pectra upgrade, scheduled for 2025, is a joint upgrade of Ethereum’s execution layer (“Prague”) and consensus layer (“Electra”). It introduces several significant protocol changes, including one of the most impactful modifications to Ethereum’s staking architecture to date: EIP-7251.

EIP-7251: Raising the Validator Stake Limit

EIP-7251 increases the maximum effective balance per validator from 32 ETH to 2,048 ETH. This change is designed to address long-standing inefficiencies in staking operations:

Operational Consolidation: Institutional validators previously had to run thousands of validator instances to manage large stakes. EIP-7251 enables consolidation, reducing the number of keys, machines, and monitoring systems required.

Reduced Network Overhead: Fewer validators mean lower resource usage for syncing, attesting, and block production, improving network efficiency.

Alignment with Capital Distribution: In practice, Ethereum’s stake is already concentrated among a limited number of operators. The previous 32 ETH cap fragmented their stake across many validators without meaningful decentralization benefits.

Trade-Offs and Security Considerations

While EIP-7251 improves capital efficiency, it also introduces new risks:

Increased Economic Risk Per Validator: A validator staking 2,048 ETH carries more systemic weight. In the event of compromise or slashing, the consequences are amplified.

Centralization Pressure: Large entities may be further incentivized to consolidate their operations, potentially reducing validator diversity and increasing risks related to collusion or censorship.

Reduced Redundancy: Fewer validators with more stake each may also reduce the fault tolerance of the system in certain scenarios.

Importantly, this change does not eliminate the option for smaller participants to run 32 ETH validators. It simply removes artificial constraints on larger ones.

Additional EIPs in the Pectra Upgrade

In addition to staking reforms, Pectra introduces several important technical improvements:

EIP-7702 – A refinement of account abstraction, allowing externally owned accounts to temporarily behave as smart contract accounts. This enables new wallet features like gas sponsorship and transaction batching.

EIP-7691 & EIP-7742 – Expand and dynamically adjust blob storage capacity, improving scalability and lowering fees for rollup-based Layer-2 solutions.

EIP-7002 – Enables validator withdrawals to be triggered via smart contracts, increasing flexibility for staking pools and custody providers.

EIP-6110 – Moves validator deposit handling fully on-chain, reducing complexity and increasing transparency.

Ethereum Governance vs Ethereum Foundation

The Pectra upgrade also serves to clarify a frequent misconception: the Ethereum Foundation does not decide protocol changes unilaterally.

While Foundation-affiliated researchers play an influential role in proposing and analyzing EIPs, governance is driven by coordination among independent client teams, researchers, and community stakeholders. While officially the Ethereum Foundation supports development, but and protocol decisions are emergent from open, consensus-based processes, 10 individuals are responsible for proposing 68% of all implemented EIPs, according to a study from the University of Texas and University of Basel (Decentralized Crypto Governance? Transparency and Concentration in Ethereum Decision-Making, Fracassi et al, 2024)

10 individuals are responsible for proposing 68% of all implemented EIPs

Conclusion

Ethereum’s governance model allows for deliberate, transparent, and technically driven upgrades—without relying on centralized decision-makers. The EIP process ensures that protocol changes are subject to rigorous scrutiny, wide input, and real-world testing.

Pectra illustrates how Ethereum continues to refine its staking infrastructure and improve user functionality, all while balancing trade-offs around decentralization and system integrity.

Ethereum’s capacity to evolve is one of its greatest strengths. As past upgrades like The Merge and Dencun have shown, the network is designed not to stand still, but to adapt. And the future of Ethereum—just like its past—is shaped not by fiat, but by consensus.