7 Things You Need to Know About Unichain, Uniswap's Latest L2

On February 11th, just weeks after the launch of Uniswap (v4), Uniswap Labs launched Unichain, a new Layer-2 (L2) blockchain within the Ethereum ecosystem. As Ethereum’s L2 landscape continues to expand, Unichain introduces several optimizations tailored to Decentralized Finance (DeFi). This article examines Unichain’s design, unique features, and its potential impact on liquidity, MEV, and transaction execution.

Problem

As Uniswap (v2, v3, v4) has expanded across multiple blockchains, its liquidity has become increasingly fragmented, leading to inefficiencies in capital allocation and higher operational costs. Maintaining multiple deployments across Ethereum, Optimism, Arbitrum, Polygon, ZKsync, and other chains introduces complexity and inefficiencies in trading execution. Additionally, Uniswap, as a decentralized exchange (DEX), lacks a unified mechanism for handling Maximal Extractable Value (MEV), allowing third-party searchers to capture value at the expense of liquidity providers (LPs).

Solution

Unichain was developed to solve these challenges by consolidating liquidity into a single DeFi-optimized rollup, L2 blockchain on Ethereum. Built using the OP Stack, it enhances capital efficiency, implements MEV internalization mechanisms to redistribute MEV back to users, and introduces faster state updates to improve execution speed. By creating a more scalable, cost-efficient, and MEV-aware environment, Unichain aims to boost efficiency of DeFi while maintaining interoperability within the broader Ethereum ecosystem.

Background

Uniswap Labs has developed multiple innovations over time, forming an interconnected DeFi ecosystem:

Uniswap v1/v2 – Early versions of Uniswap, the first Decentralized Exchange (DEX), implementing constant product Automated Market Maker (AMM).

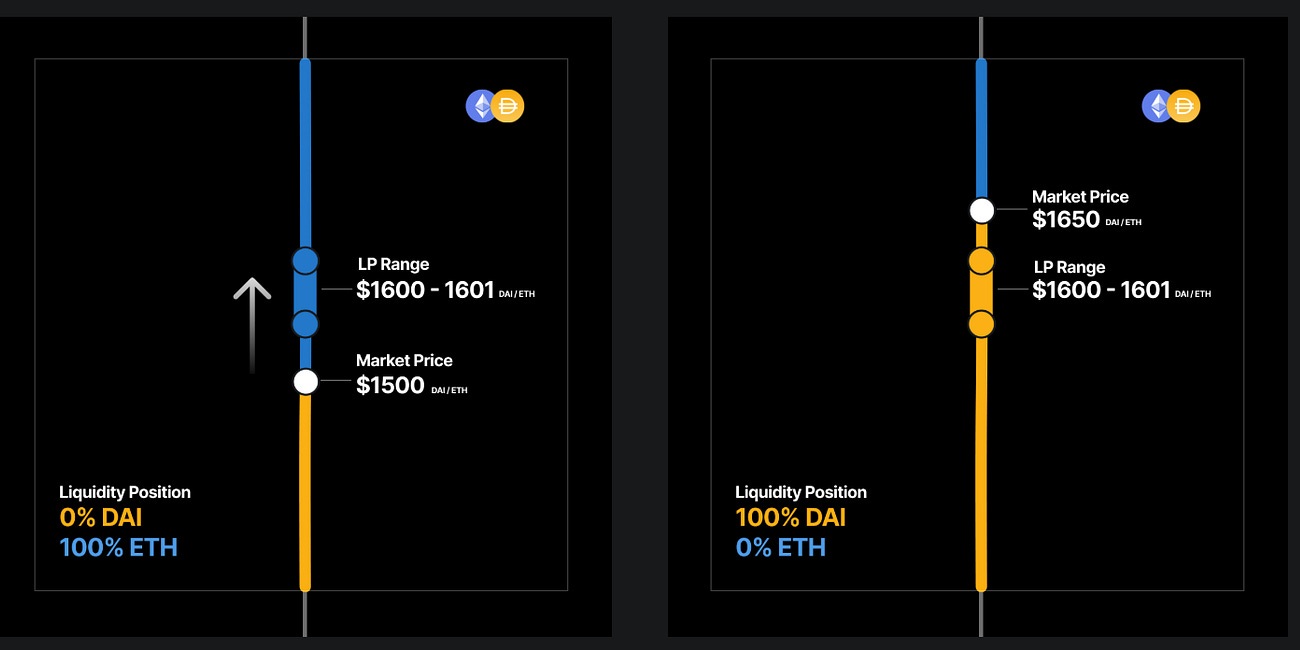

Uniswap v3 – Introduced concentrated liquidity, enabling liquidity providers (LPs) to allocate capital within specific price ranges.

UniswapX – A routing system utilizing solvers for trade optimization.

Uniswap v4 – Introduced hooks, enabling customizable AMM pools with dynamic pricing and automated strategies.

Unichain – A DeFi-focused rollup, Layer-2 (L2) blockchain, built on top of Ethereum.

You can learn more about Uniswap (v4) and the concepts of hooks in my previous post:

Uniswap v4 Launch: A New Era for DeFi and AI Integration

On January 30th, Uniswap v4 was launched, marking a major milestone for Decentralized Finance (DeFi). Uniswap has processed almost $3 trillion in trading volume and remains one of the leading protocols deployed across Ethereum and its rollups.

This post further explores seven key aspects of Unichain and how it could shape the future of DeFi.

1️⃣ Unichain Is an Optimistic Rollup, Built on the OP Stack

Unichain is an Optimistic Rollup, meaning transactions are processed outside of Ethereum, bundled (rolled), and later the transaction batch is posted on Ethereum for security. Built using the OP Stack, it is fully compatible with Optimism, Base, and other OP-Stack rollups.

Key Benefits:

Transaction history remains secured by Ethereum’s consensus layer.

Leverages the Optimistic Rollup model for cost efficiency and scalability.

Unichain remains interoperable with Ethereum and other OP Stack rollups.

2️⃣ Unichain Aims to Solve Liquidity Fragmentation in DeFi

Currently, Uniswap operates across multiple blockchains (Ethereum, Arbitrum, Optimism, Polygon, ZKsync etc.), which leads to:

Liquidity fragmentation—capital is scattered across chains, reducing efficiency.

Higher maintenance and deployment costs—supporting multiple networks is resource-intensive.

Unichain’s Approach:

Unichain remains interoperable with Ethereum and other OP Stack rollups, allowing for cross-rollup resource sharing.

Improves capital efficiency, making it easier to trade assets at scale.

By unifying liquidity into a single rollup, Unichain could eliminate inefficiencies and deepen capital pools, making DeFi trading more effective.

However, the current deployments of Uniswap DEX on other chains will be maintained, and it is expected that the traders and LPs will migrate to Unichain because of the better economic conditions.

3️⃣ It Separates Sequencers and Block Builders for Fairer MEV Handling

In most rollups, sequencers have the power to determine transaction ordering, which can lead to centralized MEV extraction. Unichain introduces a separation between sequencers and block builders to enhance fairness and employs TEE (private computations).

Key Features:

Independent block builders prevent centralized MEV control.

Implementing Trusted Execution Environments (TEEs) to verify compliance with transaction ordering rules. Transactions are ordered transparently via TEE, reducing manipulation.

Minimizing transaction failures by introducing trustless revert protection.

This structure minimizes reliance on centralized sequencers, reducing manipulative MEV practices while improving transaction ordering transparency.

4️⃣ Faster Block Times Improve DeFi Execution Efficiency

DeFi protocols require fast transaction execution to support AMMs, lending, and intent-based systems. Unichain introduces significantly faster block times compared to other L2 solutions.

Comparison of Block Times:

Ethereum → ~12 seconds

Optimism → ~1 second

Unichain → 200-250ms

Key Benefits:

Reduces slippage and failed transactions for AMMs.

Improves capital efficiency for traders and liquidity providers.

Enhances the responsiveness of lending protocols and derivatives markets.

Faster block production means smoother DeFi operations, better trade execution, and improved user experience for both retail and institutional traders.

5️⃣ It Introduces an MEV Tax to Redistribute Value to Users

MEV (Maximal Extractable Value) has long been a challenge in DeFi, where arbitrageurs extract value at the expense of liquidity providers and traders. MEV is an inherent part of blockchain systems. According to MEV trilemma, it takes one of the three forms:

Explicit auctions – Searchers bid for MEV opportunities.

Spam-based auctions – Transactions compete for execution priority.

Latency-based auctions – Exploiting time delays in execution.

Unichain takes a new approach by implementing an MEV internalisation mechanism.

How MEV Tax Works:

Each application can control its own MEV auctions. MEV revenue is redistributed to DeFi users such as liquidity providers and traders.

Private mempools prevent front-running while still allowing back-running.

Instead of third-party arbitrageurs capturing MEV, Unichain ensures that value extracted from MEV is reinvested back into the ecosystem, benefiting users and liquidity providers.

For a broader discussion on MEV myths and misconceptions, refer to my previous blog:

5 Myths About MEV: Separating Fiction from Reality in Decentralized Finance

Maximal Extractable Value (MEV) has become one of the most misunderstood concepts in Decentralized Finance (DeFi). Some people always associate MEV with attacks, calling it an "MEV attack," while others claim that MEV itself is illegal. But is that really the case?

6️⃣ Unichain Uses a Decentralized Sequencer Validator Network (UVN) & UNI Staking Model

Like most rollups, Unichain still operates on a centralized sequencer - a server responsible for batching L2 transactions and posting them into Ethereum. To mitigate risk related to sequencer centralization, Unichain introduced a sequencer (Unichain) Validator Network (UVN) to improve security and governance.

Key Features:

Validators stake UNI tokens on Ethereum to secure the network.

Smart contracts track Unichain’s latest state, improving finality.

Decentralized monitoring of sequencer activity, reducing single points of failure.

This approach ensures higher decentralization, reducing risks related to transaction censorship and manipulative ordering practices. However, it also raises questions about Ethereum’s economic role if more rollups adopt non-ETH staking models.

7️⃣ Optimized for DeFi, Not Just an Appchain

Unlike some rollups designed as isolated appchains, Unichain remains a generalized DeFi-focused blockchain, ensuring seamless interaction with Ethereum-based protocols.

Key Features:

Interoperable with Ethereum & other OP Stack rollups (Optimism, Base, etc.).

Supports faster block production.

Offer MEV internalization to any DeFi protocol deployed on Unichain

Rather than being a siloed app chain, Unichain enhances the DeFi ecosystem, ensuring DeFi protocols can leverage all of its innovations and security guarantees.

Discussion

Why not ZK Rollup?

You might wonder why Unichain was launched as an Optimistic Rollup rather than a ZK Rollup. There are likely two primary reasons for this decision.

The first reason is Ethereum Virtual Machine (EVM) compatibility. Optimistic Rollups provide full EVM equivalence, allowing developers to seamlessly deploy existing Ethereum smart contracts without modifications. While ZK Rollups are making progress toward EVM compatibility, they have not yet achieved full equivalence, which can introduce additional complexity for developers migrating from Ethereum.

The second reason is cost efficiency. Generating ZK proofs is computationally expensive, leading to higher transaction costs for users. By adopting the Optimistic Rollup model, Unichain maintains low transaction fees (around $0.01 per transaction) and avoids the high costs associated with ZK proof generation. Although ZK Rollups are actively working on reducing these costs, they remain a limiting factor for now.

However, this approach also comes with some trade-offs. Unlike validiums, a type of ZK Rollup that keeps transaction data off-chain, all transactions on Optimistic Rollups are publicly visible on Ethereum, which may raise privacy concerns. Additionally, centralized sequencers in Optimistic Rollups introduce potential risks, such as censorship or manipulation. To mitigate this, Uniswap has introduced the Unichain Sequencer Validator Network, ensuring greater decentralization and accountability in transaction ordering.

(No) Value Captured by Ethereum

With the Unichain Validator Network (UVN), Unichain aims to mitigate the risks related to the reliance on centralized sequencers, especially as an optimistic rollup that does not generate transaction ZK validity proves. Unichain’s validators stake UNI tokens on Ethereum’s mainnet to monitor sequencer activity, improving economic security and decentralization. Smart contracts on Ethereum track Unichain’s latest state, ensuring transactions remain verifiable and reducing reliance on Ethereum’s long finality window.

Unlike the current trend of relying on ETH staking (via re-staking), Unichain’s validator network operators stake Uniswap’s UNI tokens, driving its value and utilization. This raises a broader concern regarding the long-term value capture of Ethereum and ETH. If more rollups follow this model, Ethereum’s role as the primary economic layer could diminish, similar to the challenges that the ATOM token has within the Cosmos ecosystem.

Conclusion

Unichain is a DeFi-optimised Ethereum L2, built using the OP Stack as an optimistic rollup. It introduces several novel features designed to improve DeFi efficiency, MEV management, and fast and efficient transaction execution:

Separation of Sequencer and Block Builder roles with TEE.

Fast block production (200ms) and transaction revert protection.

MEV Tax to redistribute extracted value back to users and liquidity providers.

Decentralized Sequencer Validator Network (UVN) to enhance security and governance.

Unlike application-specific chains (appchains), Unichain remains open to the deployment of any DeFi protocols.

Interested in AI-Native DeFi and RWA Integration?

I am actively working on AI-native DeFi protocols and tokenized RWA integration into DeFi. If you're exploring AI in DeFi, MEV mitigation, or RWA, let’s discuss opportunities for collaboration!

Source: Unichain Whitepaper